About Financial Advisor Brisbane

Table of ContentsFinancial Advisor Brisbane Fundamentals ExplainedThe Financial Advisor Brisbane DiariesSome Ideas on Financial Advisor Brisbane You Should KnowThings about Financial Advisor BrisbaneHow Financial Advisor Brisbane can Save You Time, Stress, and Money.Some Known Questions About Financial Advisor Brisbane.Our Financial Advisor Brisbane StatementsNot known Facts About Financial Advisor BrisbaneUnknown Facts About Financial Advisor Brisbane

An economic expert is a specialist in their very own right and provides financial guidance to clients. They should have a good understanding of investing and the financial markets to be successful in this profession. A financial advisor's work summary covers what the task entails and the KSAOs essential for a prospect to prosper.The economic advisor will certainly deal with investments, home mortgages, and insurance coverage policies in a specific setting. A financial adviser in a company setup will use guidance on pension plans, investments, home loans, and insurance items. Prospects who are chosen will certainly demonstrate a high degree of competence in financial investment, bonds, and supplies. Customers seek the recommendations of financial advisors on various subjects, consisting of yet not limited to: investments, tax obligations, estate planning, accounts, insurance coverage, home mortgages, and retired life preparation.

Not known Details About Financial Advisor Brisbane

When working with an economic expert, you can anticipate them to ask you several inquiries regarding your monetary goals and run the risk of tolerance. They will certainly after that supply suggestions on exactly how to save finest and invest your money. Toronto locals seeking numerous financial services can especially profit from the expertise of a local monetary advisor as there are some monetary subtleties details to this city.

Deals guidance to customers on readily available financial investment choices to enable them to choose the best alternatives - Financial Advisor Brisbane. Offers clients strategies for spending in insurance protection, money monitoring, and investment planning. Recommends customers on altering economic and financial investment fads to aid them in making informed options regarding investments in their chosen areas

Some Known Incorrect Statements About Financial Advisor Brisbane

Locates investment services or products for the clients to optimize returns. Evaluate choices around retirement preparation to make it possible for customers to select the most effective retirement plans. Tracks the client's life events to comprehend their demands better and recommend them on readily available financial investment options. Translates monetary and investment reports in support of customers to aid them in having a deeper understanding of the efficiency of their financial investments.

Develops client connections that help them in providing new investment product or services. Consults with customers to comprehend their financial needs and objectives, threat resistance, earnings, and possession profiles to aid them in choosing the optimal financial investment choices. Offers suggestions to customers on offered investment alternatives and financial debt administration instruments to enable customers to make far better selections on offered alternatives.

Some Ideas on Financial Advisor Brisbane You Need To Know

Tracks market performance to establish personalized investment guidance and strategies for clients. The certifications required to hold this task differ from country to country, yet generally the fad is that candidates for this duty need to possess a business degree. A few of the certifications needed in this role are FCA, CII, DipFA, and CISI.

Here I detail the basic academic needs for a financial advisor. An initial degree in financing or any kind of related business level is required. Qualifications associated with economic advisory workA industrial masters degree is sometimes called for or put as an added advantage. Comprehensive knowledge of insurance policy, mutual funds, and safety and securities is needed.

What Does Financial Advisor Brisbane Mean?

For even more elderly financial experts, the demands are greater such as 5 years of experience in a managerial role. Listed below I list the experience needs to place in a task summary of an economic advisor: i thought about this The job required 3 years minimum of experience. Experience in a comparable of the associated role is a compulsory demand.

Every job calls for a specific to possess the knowledge, skills, capacities, and other characteristics, and the task summary of an economic advisor is not an exception. I listed here several of the various other features required for this work. Strong negotiation skills are required. Ability to understand financial and financial trends is a requirement.

The work summary of an economic advisor need to clearly lay out the primary responsibilities, and the KSAOs required for a specific to be successful in this role (Financial Advisor Brisbane). Beyond this, a number of qualifications need to be called for depending upon the degree of expertise in the role. I take into consideration the work description of a monetary consultant above to be an excellent sample

7 Easy Facts About Financial Advisor Brisbane Described

They're managed by the U.S. Stocks and Exchange Commission (SEC) or state protections regulatory authorities. An efficient economic organizer must have adequate education and learning, training, and experience to recommend certain economic items to their customers. A specialist may earn and bring one or more expert classifications as evidence of these certifications such as the licensed economic organizer title.

The Of Financial Advisor Brisbane

Fee-only consultants gain earnings only with fees paid by their customers. Commission-based financial experts make revenue by offering economic items and opening up accounts on their clients' behalves. The compensations are repayments made by companies whose services and products are suggested by the consultant. Commission-based consultants can likewise gain cash by charge account for clients.

Fee-only organizers have no such lure. When you prepare to hire your very first expert or replace your present expert, it's an excellent idea to meeting at the very least three economic organizers. my sources Compare their responses so you can pick the one that's best for your requirements. Make sure to get the answer to these concerns: What are your credentials? Can you provide references? What (and just how) do you charge? What is your location of know-how? Will you serve as my fiduciary? What solutions can I expect? How will we clear up disagreements? You can check out the CFP Board web site to inspect the condition of a CFP.

The Buzz on Financial Advisor Brisbane

The task summary of a financial consultant should clearly detail the key tasks, and the KSAOs needed for an individual to be effective in this role. Over and above this, a number of accreditations must be needed relying on the degree of specialization in the function. I think about the job description of a monetary consultant over to be an excellent sample.

An Unbiased View of Financial Advisor Brisbane

They're managed by the U.S. Securities and Exchange Compensation (SEC) or state protections regulators - Financial Advisor Brisbane. An efficient monetary coordinator needs to have enough education and learning, training, and experience to advise certain financial products to their customers. A practitioner may make and carry one or more specialist classifications as evidence of these credentials such as the certified economic coordinator title

Fee-only coordinators have no such temptation. When you're all set to employ your first consultant or replace your present advisor, it's a great idea to meeting at the very least 3 economic organizers. Compare their solutions so you can pick the one that's finest for your demands. Make certain to get the answer to these concerns: What are your qualifications? Can you provide referrals? What (and exactly how) do you charge? What is your location of expertise? Will you function as my fiduciary? What solutions can I expect? Exactly how will we resolve disputes? You can go to the CFP Board website to inspect the standing of a CFP.

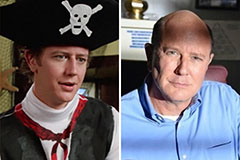

Edward Furlong Then & Now!

Edward Furlong Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Mackenzie Rosman Then & Now!

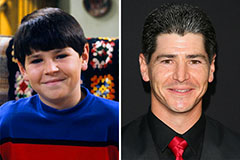

Mackenzie Rosman Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!